When planning a relocation, financial considerations are paramount. Explore the 15 Most Expensive States To Live in the US to understand where your budget may face the most strain. From the allure of California to the allure of Massachusetts, uncover which states lead the pack in terms of costly living expenses.

Read the 15 Most Expensive States To Live in the US to reveal where your finances could face the greatest challenges. Whether you’re dreaming of Hawaii’s beaches or contemplating New York’s urban lifestyle, understanding the economic terrain is essential for shaping your plans.

Hawaii tops the list with groceries and housing pushing the cost of living 80% above the national average. Massachusetts and California follow closely, driven by expensive housing, especially in coastal areas. Consider taxes, utilities, and transportation costs when comparing living expenses across states.

Boston, Massachusetts

In Boston, Massachusetts, households spend $2,656 per month or $31,867 annually on bills, surpassing the national average by 29.8%, amounting to $7,310 more annually. With an average household income of $90,015, bills make up 35% of the total income, reflecting the higher cost of living in the area.

Despite the city’s vibrant culture and opportunities, residents face elevated expenses, emphasizing the importance of budgeting and financial planning for those living in or considering a move to Boston.

Cost of Living in Boston, Massachusetts

| Aspect | Cost |

| Monthly Bills | $2,656 |

| Annual Bills | $31,867 |

| National Average Difference | +29.8% |

| Higher Annual Cost Compared to National Average | $7,310 |

| Average Household Income | $90,015 |

| Percentage of Income Spent on Bills | 35% |

Top of Form

New York

In New York, households allocate $2,495 monthly or $29,936 annually for bills, surpassing the national average by 21.9% ($5,379 more yearly). With an average income of $78,147, these expenses constitute 38% of total income, reflecting the city’s high living costs.

In the bustling metropolis, residents face significantly higher expenses, particularly for housing and utilities, requiring prudent budgeting for financial stability. Despite cultural richness and career opportunities, careful financial management is crucial for those residing or considering a move to New York.

Read this blog: http://homijazz.com/walmart-tiny-homes-to-make-your-dreams-a-big-reality/

Cost of Living in New York City

| Aspect | Cost |

| Monthly Bills | $2,495 |

| Annual Bills | $29,936 |

| National Average Difference | +21.9% |

| Higher Annual Cost Compared to National Average | $5,379 |

| Average Household Income | $78,147 |

| Percentage of Income Spent on Bills | 38% |

Top of Form

Colorado

In Colorado, households likely spend around $2,413 monthly on bills, with an annual cost aligning closely with the monthly figure. While an exact percentage increase over the national average is challenging to confirm without specific data, it underscores Colorado’s relatively higher living expenses. With an average income of $77,375, residents may allocate a significant portion of their earnings toward bills, reflecting the state’s elevated cost of living.

In Colorado’s picturesque landscapes, managing expenses demands meticulous budgeting to maintain financial stability. Effective financial management is crucial for individuals and families contemplating relocation to the state. This emphasizes the need for careful consideration of living costs before making the move.

Cost of Living in Colorado

| Aspect | Cost |

| Monthly Bills (Estimated) | $2,413 |

| Annual Bills (Close to Monthly Cost) | Close to Monthly Cost |

| Average Household Income | $77,375 |

| Percentage of Income Spent on Bills | Likely Significant |

Top of Form

New Hampshire

In New Hampshire, households likely spend around $2,413 monthly on bills, with the annual cost aligning closely with the monthly figure. While confirming the exact percentage increase over the national average is challenging, it underscores New Hampshire’s relatively higher living expenses. With an average income of $77,375, residents may allocate a significant portion of their earnings toward bills, reflecting the state’s elevated cost of living.

In New Hampshire’s scenic landscapes, residents face substantial expenses, notably for housing and utilities. Effective financial management is essential for maintaining stability, despite potential variations in average income figures. The state’s beauty highlights the need for prudent budgeting amid its relatively higher cost of living.

Read this blog also: http://homijazz.com/best-sherwin-williams-white-paint-colors-photos-helpful-review/

Cost of Living in New Hampshire

| Aspect | Cost |

| Monthly Bills (Estimated) | $2,413 |

| Annual Bills (Close to Monthly Cost) | Close to Monthly Cost |

| Average Household Income | $77,375 |

| Percentage of Income Spent on Bills | Likely Significant |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

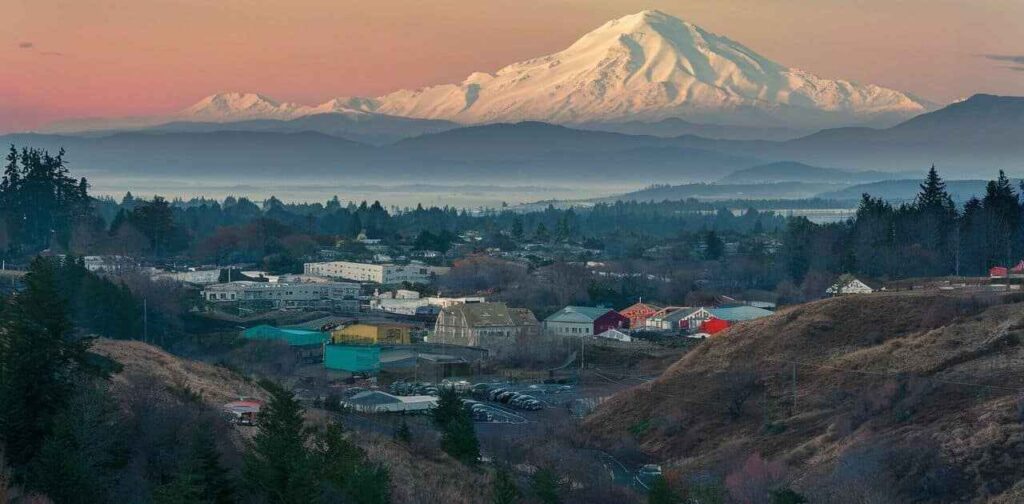

Washington

In Washington, households spend approximately $2,468 monthly on bills, closely matching the annual expenses. The state’s higher living costs are evident, with an average income of $80,881 contributing significantly to bill payments.

Amid Washington’s scenic landscapes, housing and utilities pose significant expenses. Effective budgeting is crucial for financial stability, despite potential income variations. Despite the state’s allure, managing living expenses is paramount for residents and potential newcomers alike.

Cost of Living in Washington

| Aspect | Cost |

| Monthly Bills | $2,468 |

| Annual Bills (Close to Monthly Cost) | Close to Monthly Cost |

| Average Household Income | $80,881 |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Maryland

In Maryland, households likely spend around $2,569 monthly on bills, closely aligning with annual expenses. The state’s elevated living costs are apparent, with an average income of $91,068 playing a significant role in covering these expenses.

Amid Maryland’s diverse landscapes, housing and utilities present notable expenses. Effective budgeting is essential for financial stability amidst potential income fluctuations. Despite the state’s attractions, managing living expenses remains critical for both current residents and those considering relocation to Maryland.

Cost of Living in Maryland

| Aspect | Cost |

| Monthly Bills (Estimated) | $2,569 |

| Annual Bills (Close to Monthly Cost) | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Average Household Income | $91,068 |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Hawaii

In Hawaii, households typically allocate around $3,070 monthly for bills, closely mirroring annual expenses. The state’s high living costs are evident, with an average income of $85,253 largely going toward covering these expenditures.

Amid Hawaii’s stunning landscapes, housing and utilities pose significant financial burdens. Effective budgeting is crucial for maintaining financial stability amid potential income fluctuations. Despite the state’s allure, managing living expenses is essential for both current residents and those contemplating a move to Hawaii. San Francisco, California

Cost of Living in Hawaii

| Aspect | Cost |

| Monthly Bills | $3,070 |

| Annual Bills (Close to Monthly Cost) | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Average Household Income | $85,253 |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Honolulu, Hawaii

In Honolulu, Hawaii, households typically spend approximately $3,070 monthly on bills, reflecting the state’s high living costs. With an average income of $85,253, residents allocate a significant portion of their earnings toward covering these expenses, emphasizing the financial strain.

Amid Honolulu’s breathtaking landscapes, housing and utilities present considerable financial burdens. Effective budgeting is essential for maintaining financial stability, especially amidst potential income fluctuations. Despite the city’s allure, managing living expenses is crucial for both current residents and those considering relocation to Honolulu.

Cost of Living in Honolulu, Hawaii

| Aspect | Cost |

| Monthly Bills | $3,070 |

| Annual Bills (Close to Monthly Cost) | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Average Household Income | $85,253 |

| Percentage of Income Spent on Bills | Significant |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Brooklyn, New York

In Brooklyn, New York, households face similar financial challenges, with monthly bills averaging around $2,495. The city’s renowned urban lifestyle comes with a high cost of living, where residents allocate a significant portion of their average income of $78,147 towards covering expenses.

Amid Brooklyn’s bustling streets, housing and utilities pose significant financial burdens, demanding effective budgeting for financial stability. Despite the city’s vibrant culture and diverse attractions, managing living expenses remains paramount for both current residents and those considering a move to Brooklyn.

Cost of Living in Brooklyn, New York

| Aspect | Cost |

| Monthly Bills | $2,495 |

| Annual Bills | Close to monthly cost |

| National Average Difference | Likely Higher |

| Average Household Income | $78,147 |

| Percentage of Income Spent on Bills | Significant |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Manhattan, New York

In Manhattan, New York, households face comparable financial challenges, with monthly bills averaging around $2,495. The city’s reputation for luxury living contributes to its high cost of living, where residents often allocate a substantial portion of their average income of $78,147 towards covering these expenses.

Amid Manhattan’s bustling streets and iconic skyline, housing and utilities present significant financial burdens, necessitating careful budgeting for financial stability. Despite the allure of Manhattan’s world-class amenities and cultural offerings, managing living expenses remains critical for both current residents and those contemplating a move to the borough.

Cost of Living in Manhattan, New York

| Aspect | Cost |

| Monthly Bills | $2,495 |

| Annual Bills | Close to monthly cost |

| National Average Difference | Likely Higher |

| Average Household Income | $78,147 |

| Percentage of Income Spent on Bills | Significant |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

New Jersey

In New Jersey, households encounter comparable financial challenges, with monthly bills averaging around $2,727. The state’s proximity to Manhattan adds to its relatively high cost of living, where residents often allocate a significant portion of their average income toward covering expenses.

In New Jersey’s diverse communities and bustling cities, housing and utilities pose notable financial burdens, requiring effective budgeting for financial stability. Despite the state’s attractions and proximity to New York City, managing living expenses remains critical for both current residents and those considering a move to New Jersey.

Cost of Living in New Jersey

| Aspect | Cost |

| Monthly Bills | $2,727 |

| Annual Bills | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Illinois

In Illinois, households face similar financial challenges, with monthly bills averaging around $2,569. The state’s urban centers like Chicago contribute to its relatively high cost of living, where residents often allocate a significant portion of their average income towards covering expenses.

In Illinois’ diverse communities and bustling cities, housing and utilities present significant financial burdens, demanding effective budgeting for financial stability. Despite the state’s attractions and vibrant urban life, managing living expenses remains crucial for both current residents and those contemplating a move to Illinois.

Cost of Living in Illinois

| Aspect | Cost |

| Monthly Bills | $2,569 |

| Annual Bills | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Alaska

In Alaska, households encounter comparable financial challenges, with monthly bills averaging around $2,335. The state’s remote location and unique environment contribute to its relatively high cost of living, where residents often allocate a significant portion of their average income toward covering expenses.

In Alaska’s vast landscapes and remote communities, housing and utilities present significant financial burdens, necessitating careful budgeting for financial stability. Despite the state’s natural beauty and outdoor opportunities, managing living expenses remains crucial for both current residents and those considering a move to Alaska.

Cost of Living in Alaska

| Aspect | Cost |

| Monthly Bills | $2,335 |

| Annual Bills | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Rhode Island

In Rhode Island, households face similar financial challenges, with monthly bills averaging around $2,504. The state’s coastal location and smaller size contribute to its relatively high cost of living, where residents often allocate a significant portion of their average income toward covering expenses.

In Rhode Island’s charming coastal towns and bustling cities, housing and utilities present significant financial burdens, necessitating careful budgeting for financial stability. Despite the state’s scenic beauty and historical attractions, managing living expenses remains crucial for both current residents and those contemplating a move to Rhode Island.

Cost of Living in Rhode Island

| Aspect | Cost |

| Monthly Bills | $2,504 |

| Annual Bills | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Oregon

In Oregon, households encounter comparable financial challenges, with monthly bills averaging around $2,468. The state’s diverse landscapes and desirable urban areas contribute to its relatively high cost of living, prompting residents to allocate a significant portion of their average income toward expenses.

In Oregon’s scenic coastlines, lush forests, and vibrant cities, housing and utilities pose significant financial burdens, demanding effective budgeting for financial stability. Despite the state’s natural beauty and outdoor recreational opportunities, living expenses remain critical for current residents and those considering a move to Oregon.

Cost of Living in Oregon

| Aspect | Cost |

| Monthly Bills | $2,468 |

| Annual Bills | Close to Monthly Cost |

| National Average Difference | Likely Higher |

| Key Expenses | Housing, Utilities |

| Financial Planning | Essential |

Frequently Asked Questions

Which US state has the highest cost of living?

Hawaii has the highest cost of living in the United States.

What is the #1 most expensive city in the US?

The #1 most expensive city in the US is New York City.

What US state is the cheapest to live in?

Mississippi is often considered the cheapest state to live in the United States.

Is Oregon cheaper than California?

Generally, Oregon is considered to be cheaper than California in terms of cost of living, although specific expenses can vary depending on the location within each state.

What state is like California but cheaper?

Arizona is often considered to be like California but cheaper in terms of cost of living.

Is Arizona or Oregon more expensive?

Oregon tends to be more expensive than Arizona in terms of overall cost of living.

What state should I move from California?

Consider states like Arizona, Nevada, or Texas for a lower cost of living than California.

Conclusion

The ranking of the 15 Most Expensive States to Live in the US sheds light on the financial challenges faced by residents across the country. From the tropical shores of Hawaii to the bustling streets of New York City, high living expenses are a common concern for many Americans. The data highlights the significant impact of housing, utilities, and other essential expenses on household budgets, underscoring the importance of effective financial planning and budgeting.

Despite the allure of living in these states with their unique attractions and opportunities, managing living expenses remains paramount for residents. Whether considering a move or currently residing in one of these states, understanding the financial landscape is crucial for maintaining financial stability and ensuring a comfortable standard of living.

Howdy is behind this home blog, sharing personal stories, thoughts, and insights from daily life. I can dedicated to bringing you the latest trends, expert advice, and creative ideas to make your home the sanctuary you’ve always dreamed of. Whether you’re looking for DIY tips, home decor inspiration, home loans, rentals or renovations.